How Can I Get a Copy of My Credit Report

Getting your free credit reports.

It's not like the fake gratis, but the real 100% complimentary, gratis.

Here'due south how reporting works:

We'll help you along your financial journey — one stride at a time.

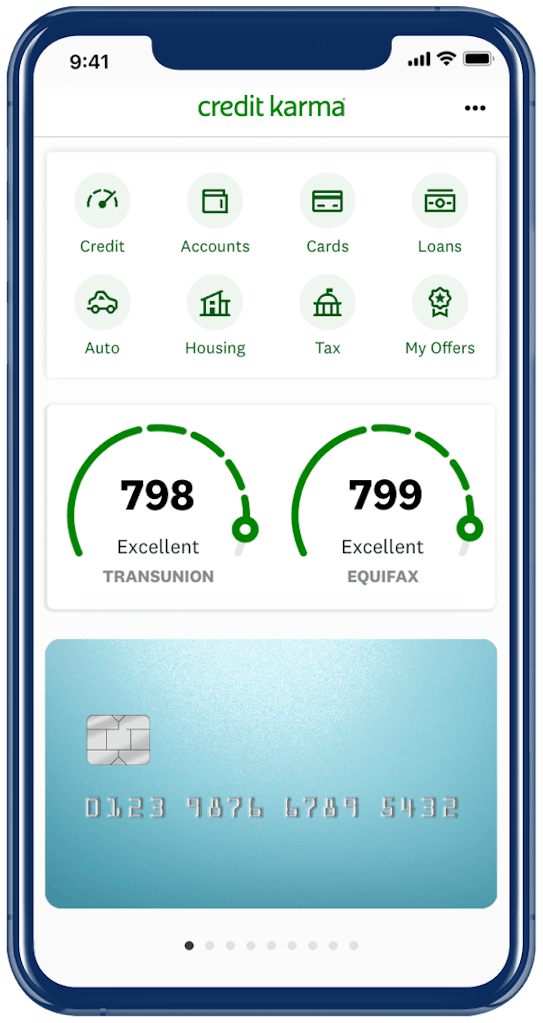

Two is better than one

See your TransUnion ® and Equifax ® credit reports anytime.

Building credit

Learn how to achieve your financial goals with our free tips and tools.

Stay up to date

Get notified when there are important changes to your credit reports.

Go the correct tools

Cull from credit carte and loan options that could work best for your fiscal needs.

Editorial Note: Credit Karma receives compensation from third-political party advertisers, but that doesn't affect our editors' opinions. Our third-political party advertisers don't review, approve or endorse our editorial content. It'south accurate to the all-time of our noesis when posted.

How to read and understand your free credit reports

Updated June xx, 2021

This date indicates our editors' last comprehensive review and may not reflect recent changes in individual terms.

Written by: Tim Devaney

If you're looking for your free credit reports, you've come to the right identify. Credit Karma offers free credit reports from two of the three major consumer credit bureaus, Equifax and TransUnion.

But if you've never seen your credit reports before, you might not understand what you're looking at. Allow'southward review what you lot might detect on your credit reports and how that information can bear on your credit scores and overall financial health.

- What'south on my credit reports?

- Credit reports vs. credit scores: What's the deviation?

- What are the three main consumer credit bureaus?

- How can I detect and dispute errors on my credit reports?

- What is the Fair Credit Reporting Human action?

- Where can I get a costless credit study?

- Free-credit-study FAQs

What's on my credit reports?

Your credit reports incorporate personal information, likewise as a record of your overall credit history. Lenders and creditors report account information, such every bit your payment history, credit inquiries and credit account balances, to the three master consumer credit bureaus. All of that information can make its way into your credit reports.

Much of what'south constitute in your credit reports can impact whether you're approved for a credit card, mortgage, auto loan or other type of loan, forth with the rates you'll get. Even landlords may look at your credit when deciding whether to rent to y'all.

Permit's dig into some of the chief components of your credit reports.

Credit reports vs. credit scores: What's the difference?

Each credit report has a credit score associated with it (though one isn't necessarily provided to y'all with the other). This is a three-digit number based on the information in your report.

Nigh credit scores range from 300 to 850. Where your score falls in this range tin can determine how probable you are to be approved for a loan, and whether y'all'll authorize for the best rates and terms.

It can be helpful to call back of a credit score equally a letter course you go far school, while a credit report is like a listing of all the homework, tests and quizzes that go into earning that grade.

Credit Karma offers free credit reports and complimentary credit scores from Equifax and TransUnion, two of the three major consumer credit bureaus. Speaking of which …

What are the three main consumer credit bureaus?

The 3 main consumer credit bureaus are Equifax, Experian and TransUnion. A credit bureau is a company that collects and stores data about yous and your financial accounts and history, so uses this information to create your credit reports and credit scores.

How credit bureaus get your data

Lenders may send data about your credit accounts to one or several of the credit bureaus. The credit bureaus may besides collect information about sure derogatory marks from courtroom records. All of this data is then compiled and used to generate your credit reports.

Why you could accept different credit reports from unlike bureaus

The credit bureaus can only report on the information that's provided to them. Since lenders are not required to written report to all 3 major credit bureaus, you might find information most certain accounts on one credit report, just non others.

Even when lenders do study information to all iii major bureaus, they may report that information at unlike times. Given all the credit information included in a typical credit report, it's perfectly normal to observe some small differences between your credit reports.

Mistakes do happen from time to time. If you retrieve your credit reports are different due to legitimate errors, you lot can dispute those errors with each credit bureau.

How can I notice and dispute errors on my credit reports?

If you lot discover any big discrepancies between your credit reports, in that location might exist an fault. There are a number of ways to detect and dispute these errors . Let's take a look at a few.

Where can I get a costless credit study?

Credit Karma partners with Equifax and TransUnion to provide gratuitous credit reports from those ii bureaus. Your reports can exist updated weekly, and y'all can cheque them equally oft as you like with no impact on your credit scores.

Under the Fair Credit Reporting Act, you are also entitled to a complimentary annual credit written report each year from each of the iii major consumer credit bureaus. To asking a gratuitous copy of your credit reports from Equifax, Experian and TransUnion, visit the official site, annualcreditreport.com.

What is the Off-white Credit Reporting Act, or FCRA?

The Fair Credit Reporting Act is an important police that gives you the right to know the information that the credit bureaus keep on you and how that information informs your credit scores.

This law includes a number of consumer rights and protections. For example, under the FCRA you lot have the right to dispute incomplete or inaccurate information on your credit reports. In near cases, the credit bureau must investigate your case and right or remove whatsoever inaccuracies inside xxx days.

Free-credit-study FAQs

Does checking my gratis credit reports hurt my credit?

No, checking your gratis credit reports on Credit Karma will not injure your credit. This is considered a soft research.

Are Credit Karma'southward free credit reports accurate?

The credit reports y'all encounter on Credit Karma come directly from Equifax and TransUnion and should reflect any information reported by those credit bureaus. If you spot an error on either of those credit reports, Credit Karma tin can help y'all dispute it .

Which credit study is most accurate?

No one credit report is innately more authentic than the others. Your TransUnion credit study might comprise data that your Equifax credit report doesn't, or vice versa.

This is partly because lenders are not required to report your information to all three credit bureaus. In some cases, they may only written report to one agency and not the others, or they may written report data at different times.

In any case, it's a expert idea to review your credit reports on a regular footing so that you can be sure any discrepancies are minor.

Source: https://www.creditkarma.com/free-credit-report

0 Response to "How Can I Get a Copy of My Credit Report"

Post a Comment